To manage our money, every December or January, I’ll prepare a yearly savings plan. This plan is simply a spreadsheet to project out week by week the money that comes and goes from my checking account. It’ll help me plan and keep track of the total amount I’ll be saving in my TFSAs as well as RRSPs, while ensuring I maintain a specific amount in my savings account.

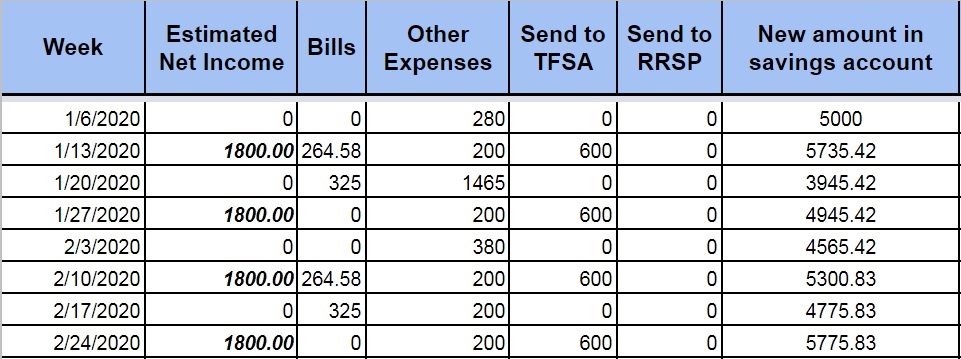

Here’s a quick overview of my yearly savings plan worksheet’s week by week tracking with fictional amounts :

In this example, I’ve assumed that we have a 5000$ amount to begin with in our savings account and that this is the minimum we would like to maintain in that account as an “emergency fund”. I then predict out my cash flow throughout the year to come.

See below the article for a link to My Yearly Savings Plan Worksheet Template which you can copy to use if your wish!

Columns in my yearly savings plan:

A. Estimated Net Income

The Estimated Net Income column is where you’ll input any income that will hit your checking account. What we’re planning out here is a cash flow projection therefore you want to use the net amount, that is after income tax and other deductions are removed from your gross paycheck amount.

If you have any other income, such as side-hustles or if you want to include any government issued payments such as the CCB in your cash-flow projections, that is where you would add these amounts.

I like to keep a minimum amount in my checking account for unplanned payments to be able to go through without incurring an overdraft or in case of an emergency. It’s a small part of my emergency fund, the rest of my emergency fund is mostly kept in my savings account.

I’ve also set a notification email from my bank in case the amount falls below a certain threshold. I’ve been using Tangerine for all my main banking, and they have various easy ways to set such alerts up.

B. Bills

Bills is an interesting column to project out. The first year I did this sheet, I simply used half of the amount we usually spend on a yearly basis, to account for my part of the bills, and then split it up in 12 payments as if these were each credit card bills I would need to pay.

This was a bit silly as it didn’t account for large payments that may require more liquidity upfront such as our municipal taxes. It also did not account for the fact that we actually have various credit cards. This varies depending on which credit card rewards we are collecting but right now we have two common credit cards which we use for our shared expenses, we each also have a personal credit cards for our separate expenses.

I’ve since been using a second worksheet in my yearly savings workbook to track every single credit card bill that we pay during the year. Once the year is done, I then average out the amounts paid on each of the statements. I then set these average amounts in my next year’s Saving Plan column B, under Bills,.around the time the statement of each of the cards should be issued.

You could therefore use the past years credit card statements in order to plan a similar average. You could even choose to use the budgeted amount you want to spend on a monthly basis on your credit card as the amount to input in the BIlls column. It really is up to you but try to be as realistic as possible as this will help you plan out how much money you can realistically save.

C. Other Expenses

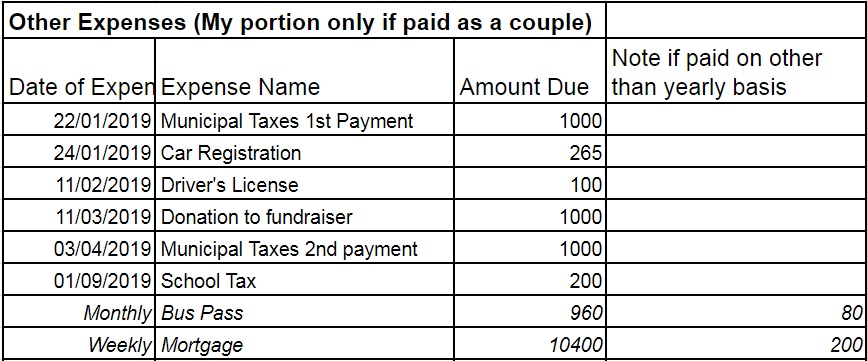

As for the bigger expenses and more specifically anything that doesn’t fall on our credit cards, they’ll find themselves in the C column: Other Expenses.

This can contain many things, such as your driver’s license renewal, your mortgage or rent payment and/or the amount you pay for municipal taxes. I’ve found it helps with the next years planning to keep track of these separately.

You’ll want to make sure to input these on the dates you will be paying those amounts in order to help plan out your cash flow needs. It’s therefore important to differentiate between the payments that occur once every year to those that happen on a monthly or weekly basis such as your mortgage.

I’ve personally been using the previous years payments and I’ll look ahead to see if anything might be different according to my plans for the year to come. I then add these expenses under the Other Expenses column according to the closest date that those expenses would be occurring.

Here’s an example of the table I would use to track these expenses in my bills/expenses estimate worksheet:

D. / E. Send to TFSA & RRSP

The D & E columns are fun to plan out as these will tell us how much we want to be saving at each paycheck in our TFSAs and/or RRSPs.

The reason I choose to invest on a bi-weekly frequency, or more specifically after every paycheck, is firstly, that I want to create a habit of logging into my account regularly to check the status of my savings & checkings account before manually transferring an amount of money into my self-directed investment accounts.

Secondly, by investing money on a regular basis, I feel that I am minimizing the impact of fluctuations in the market. Finally, it also helps that I have no costs associated with sending the amount into my investment accounts and no added costs for any ETF purchase therefore doing this on a bi-weekly basis does not cost me anything more.

You want to choose the frequency of investing that makes most sense for you. If you have fees every time you contribute money to your investments accounts or when you purchase ETFs, then you probably want to weigh those into how often you send the money into your investment accounts.

You may also be able to automate the transfer from your checking account to your own choice of investment account I personally like to log in manually and verify the amounts in all my accounts before sticking to my savings plan.

It’s also important to look at your CRA My Account for your contribution limits in your RRSPs and TFSAs. We personally always want to max out our RRSPs first, that is after March 1st to contribute to our 2020 RRSP space. It therefore depends on your own income tax situation to decide when you should contribute to your TFSA, RRSPs or both.

To establish the amount I’ll be able to send to either my TFSA or RRSP investment accounts, in a third worksheet in my yearly savings plan, I’ll simply do a calculation of my estimated total projected net income to be received during the year and subtract the total of my projected expenses (bills & other expenses). This gives me the total amount I should be able to invest that year. I then split up this amount into 26 payments to get a general idea of what I should be contributing into my investments on a bi-weekly basis.

It will then be important to input those amounts in the D & E columns, while paying attention to the following column which will show the amount left in your savings account. I personally have larger expenses in the first 6 months of the year therefore I’ll adjust the amount I send to my investments account accordingly. I’ll keep a bit more in my savings and to cover the first six months bills and then send larger sums on a bi-weekly basis for the last 6 months of the year.

F. New Amount in Savings Account

The column that tracks the New Amount in my Savings Account is specifically used to make sure that I am not depleting the amount I wish to keep as an emergency fund.

I’ll therefore use trial and error to select the amount I’ll be sending into either my TFSAs or RRSPs at every paycheck based on the bi-weekly and yearly amount calculated in the third sheet of my yearly savings plan. I like to pick a round number but the amount is really is up to you depending on your cash flow and bills. I just like to keep it as simple as possible.

For ease of viewing, in the table above I’ve removed a few columns but you’ll notice in My Yearly Savings Plan Worksheet Template below that I normally keep three other columns with are the cumulative year-to-date balances of all that we have invested in our TFSAs, then in our RRSPs and for the last column, what I’ve sent in both TFSAs & RRSPs as a total.

Yearly Savings Plan Worksheet Template

If you want to have a look at how this would all come together, you can view my yearly savings plan worksheet template (with fictional numbers) by signing up here:

This plan has been specifically populated with 2020 dates therefore it is ready to be used to plan out your next year’s savings. Feel free to make a copy of the sheet to input your own numbers and modify it as you wish.

Finally, please remember that once you’ve sent your money into your TFSA or RRSP accounts, if you invest through self-directed investment accounts you still need to log into your account once the money is transferred in, and invest that money!

Track your Actual Numbers on a Regular Basis

Once you’ve populated the yearly savings plan worksheet, it is greatly useful to use it as a tracking sheet for the rest of the year. You may want to make a copy of your yearly savings weekly projections worksheet as well as the Bills/Other Expenses worksheet to see how your actual numbers are compared to the amounts you had projected.

This will give you valuable information for your next year’s planning while also ensuring that you keep an eye on your finances throughout the year. It will help you plan your cash flow according to any upcoming expenses.

I log in my yearly savings plan worksheet to change my numbers whenever a new credit card statement is issued or when other expenses are incurred throughout the year. I also modify it after receiving my paychecks to update the numbers and know the amount I will be sending to my TFSA or RRSP accounts.

I personally find it to be quite a motivator to see what the impact of reducing my future bills or of making more side-hustling money could have on the totals that I could add to my investment accounts.

How about you, do you have any tips on planning and tracking how much you are sending to your investment accounts? Are you using a spreadsheet similar to mine?

Very organized! I just do mine with a pen and paper 🙂 Keep up the good work.

Thank you 🙂! I’m a big spreadsheet lover lol though I still use the good old pen & paper for some of my month to month tracking!